End your tax

worries today

Get reliable back tax relief with our

team of A+ rated tax professionals

Enter your tax debt to get started:

Call for a free tax review

Call for a free tax review

Free yourself from tax Worries

If you’re receiving tax notices regarding your back taxes, it’s crucial to take prompt action. Ignoring your obligation only exacerbates the issue as penalties and fees continue to accumulate, creating a more challenging situation to tackle. Remember, the IRS will get their money – and take legal measures like wage garnishment and property seizure to ensure they receive their owed funds.

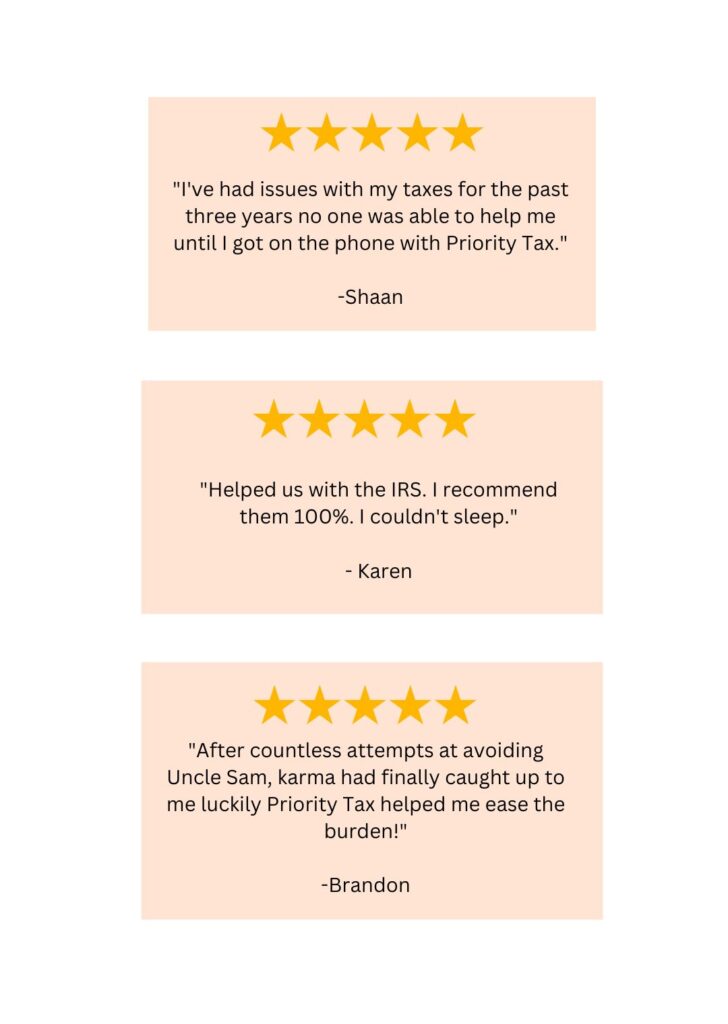

Real People. Real Relief.

Your Rights As A Taxpayer

The Taxpayer Bill of Rights (TBOR) encompasses a range of principles protecting taxpayers in their interactions with tax authorities. These principles include:

- The Right to Be Informed

- The Right to Quality Service

- The Right to Pay No More than the Correct Amount of Tax

- The Right to Challenge the IRS's Position and Be Heard

- The Right to Appeal an IRS Decision in an Independent Forum

- The Right to Finality

- The Right to Privacy

- The Right to Confidentiality

- The Right to Retain Representation

- The Right to a Fair and Just Tax System

By clicking “Submit”, I am consenting to and providing my electronic signature as express written consent for Priority Tax Relief to contact me regarding tax payment options by email, text or calls at the phone number and email provided using any automated or automatic telephone dialing device or system, prerecorded/artificial voice and/or artificial technology (Data and msg rates may apply, msg frequency varies: Text HELP for help; STOP to cancel) even if my telephone number is listed on any state or federal Do-Not-Call registry. This consent will not be shared with third parties for their marketing purposes. I may revoke this consent anytime and consent is not required as a condition to speak with Priority Tax, I can email: info@prioritytaxrelief.com