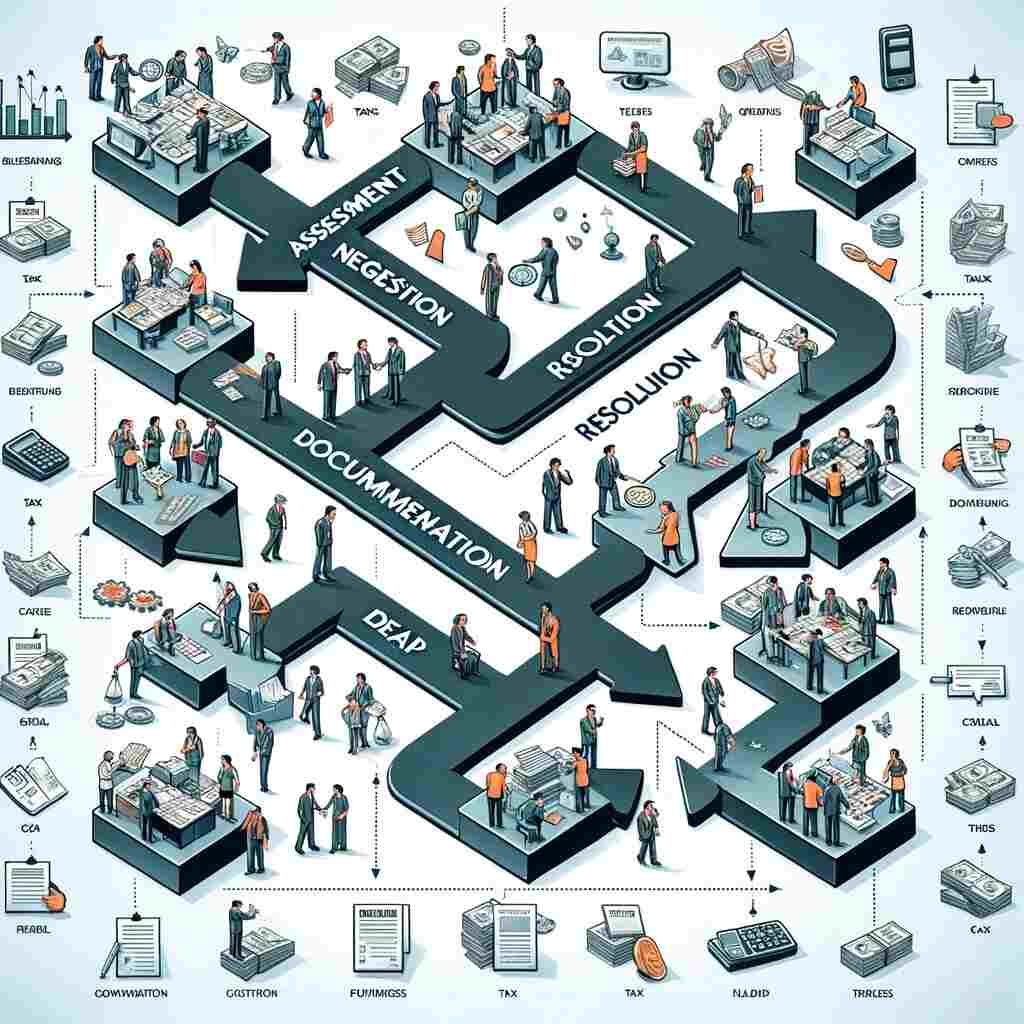

Is There a Comprehensive Roadmap for Tax Relief Resolution?

Dealing with tax debt and the associated challenges can be a daunting task. Fortunately, there are various tax relief options available to help individuals and businesses in distress. Here, we will explore the idea of a comprehensive roadmap for tax relief resolution, outlining the essential steps to address and resolve tax debt efficiently.

Assess the Situation

The first step in navigating the road to tax relief is to assess your specific situation. This involves understanding the nature and extent of your tax debt. Key considerations include:

- Type of Tax Debt: Determine whether you owe federal, state, or local taxes. Different tax authorities may have different procedures and programs for resolving tax debt.

- Total Amount Owed: Calculate the total amount of your tax debt, including any penalties and interest. This will give you a clear picture of the financial burden.

- Compliance History: Consider your tax compliance history. Have you faced previous penalties or unresolved tax issues? Your history may impact the available relief options.

Communicate with Tax Authorities

Open and transparent communication with tax authorities is crucial throughout the resolution process. Here’s how to effectively communicate:

- Contact the IRS or State Tax Authority: If you receive a notice or realize you have tax debt, contact the relevant tax authority promptly. Ignoring the issue will only lead to more significant problems.

- Request an Extension: If you need more time to gather documentation or funds, request an extension. This can help you avoid further penalties and interest.

- Discuss Relief Options: Inquire about available relief options, such as Installment Agreements, Offers in Compromise, and penalty abatement. Tax authorities may be willing to work with you to find a suitable resolution.

Create a Budget and Financial Plan

Developing a comprehensive financial plan is essential to successfully resolving tax debt. Here are the steps to include in your plan:

- Create a Budget: Design a budget that outlines your monthly income and expenses. This will help you identify areas where you can cut costs to allocate more funds toward your tax debt.

- Prioritize Payments: Make paying your tax debt a top priority to prevent further interest and penalties from accumulating. Cut back on non-essential expenses to allocate more funds for this purpose.

- Explore Payment Options: Investigate payment options, such as Installment Agreements and Offers in Compromise. These methods can help you spread the cost over time.

Seek Professional Assistance

Navigating the complexities of tax debt resolution can be challenging, and seeking professional assistance can be a wise decision. Tax professionals, such as certified public accountants (CPAs) or tax attorneys, can provide expert guidance, negotiate with tax authorities on your behalf, and help you explore potential relief options. They can also offer insight into the best approach for your specific situation.

Explore Relief Programs

There are several relief programs available to address tax debt, and eligibility for these programs varies depending on individual circumstances. Here are a few relief options to consider:

- Installment Agreements: These allow you to make monthly payments to pay off your tax debt over an extended period. The IRS may be willing to work with you to set up a manageable payment plan.

- Offers in Compromise: If paying your tax debt in full would cause severe financial hardship, you can explore an Offer in Compromise, which allows you to settle your debt for less than the full amount.

- Penalty Abatement: In some cases, you may qualify for penalty abatement if you have a valid reason for non-compliance. Discuss this option with tax authorities to see if it applies to your situation.

- Temporary Delay: In cases of extreme financial hardship, the IRS may temporarily delay collection efforts.

Establish a Long-Term Tax Strategy

While addressing immediate tax debt concerns is essential, it’s equally important to establish a long-term tax strategy. This strategy should focus on tax planning, compliance, and ongoing financial health. Some key components of a long-term tax strategy include:

- Tax Planning: Work with a tax professional to create a tax plan that optimizes your financial situation, minimizes tax liability, and ensures compliance with tax laws.

- Compliance: Stay up-to-date with tax filing and payment obligations to prevent future tax debt issues.

- Financial Health: Continuously work on improving your financial health and managing your resources to avoid future tax debt emergencies.

Monitor Progress and Adjust as Needed

The road to tax relief is not always linear. It’s important to regularly monitor your progress and make adjustments as needed. Keep the following points in mind:

- Track Payments: Keep records of your payments and communication with tax authorities. This will help you stay organized and ensure you’re meeting your obligations.

- Evaluate the Plan: Periodically assess your financial plan and budget to determine if any adjustments are required. Circumstances may change over time, and your plan should adapt accordingly.

- Seek Professional Advice: If you encounter new challenges or uncertainties, don’t hesitate to seek professional advice from a tax expert. They can provide guidance and help you navigate any unexpected issues.

Conclusion

Navigating the road to tax relief requires a comprehensive approach that includes assessing your situation, communicating with tax authorities, creating a financial plan, seeking professional assistance, exploring relief programs, establishing a long-term tax strategy, and monitoring your progress. By following this roadmap, you can effectively address and resolve tax debt while working towards a more stable and compliant financial future.